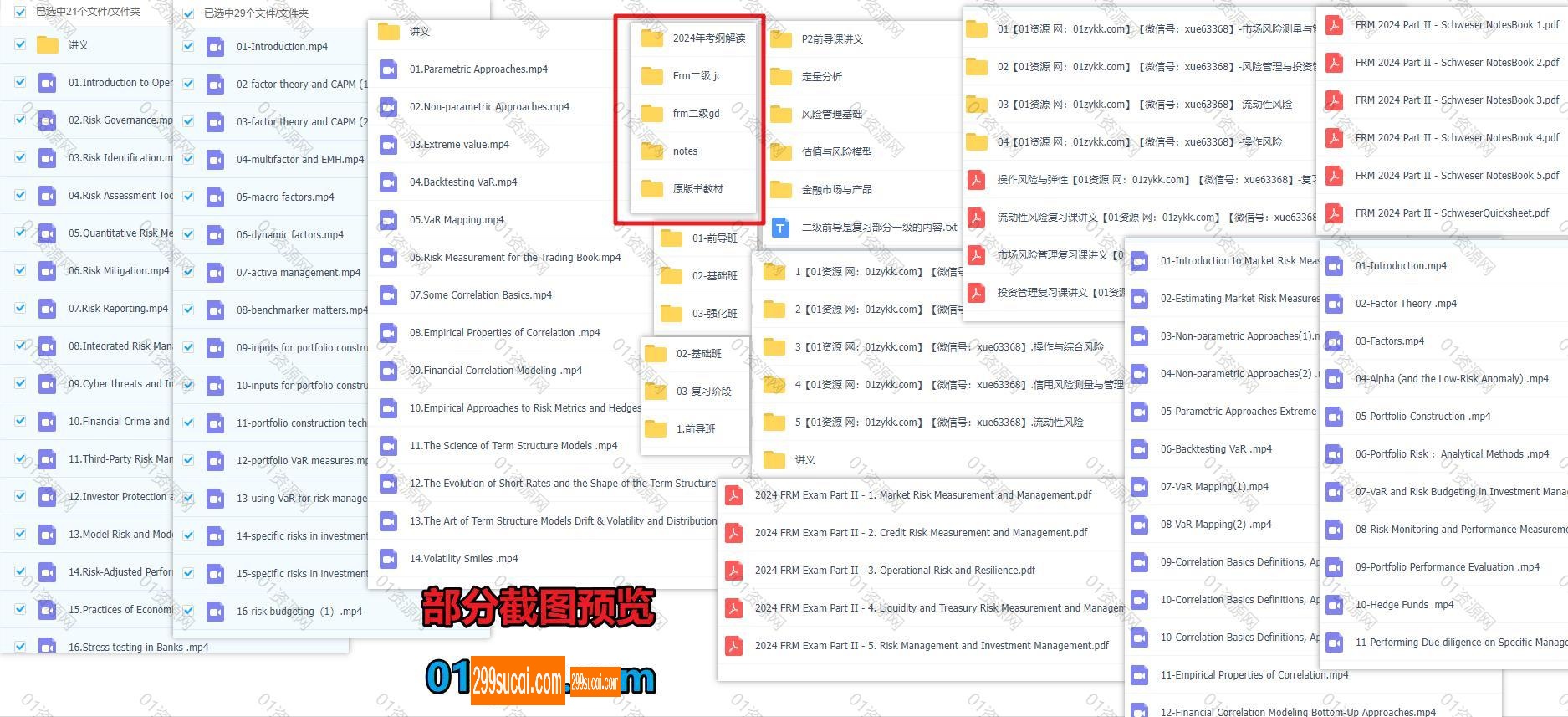

2024年FRM二级考试网课视频+电子版PDF讲义教材真题备考资料网盘合集,包含基础班/强化班/百题预测/经典题/知识精讲/课后习题…等

“考研考证”系列为01资源通过搜罗互联网整理而来的各类考研考证资源,覆盖面广,质量高。

◉ 找资源,就找299素材网,公众号:知识君眼镜哥

🎁 点击成为VIP ☛ 一次性打包获取本站全部资源+赠送各类找资源技巧教学(涵盖考研/考证/外刊/各知识付费平台等)+享永久后续新增

◉ 找资源,就找299素材网,微信号:jzb985

2024年FRM二级考试学习资料

各类考证课程在网盘群组都是持续更新,往期FRM网课资源部分目录如下:

2023/22年FRM一级考试网课视频+电子版PDF讲义教材真题备考资料网盘合集,包含基础班/强化班/百题预测/经典题/知识精讲/课后习题…等

2023/22年FRM二级考试网课视频+电子版PDF讲义教材真题备考资料网盘合集,包含基础班/强化班/百题预测/经典题/知识精讲/课后习题…等

本套资源继续收集整理了2024年FRM二级考试学习资料合集,包含2024FRM二级备考网课视频+电子版PDF讲义教材真题等,双机构平台,百度网盘分享,持续收集中,涵盖基础班/强化班/百题预测/经典题/知识精讲/课后习题…等FRM网课资源。

目录如下

【2024FRM考试网课2024FRM二级资源】 [ 43.89GB ]

| | 2024年考纲解读 [ 65.73MB ]

| | | 2024年FRM考纲变化.pdf [ 902.29kB ]

| | | 2024年考纲变动分析.mp4 [ 64.85MB ]

| | Frm二级 金程jc [ 17.16GB ]

| | | 01-前导班 [ 963.17MB ]

| | | | FRM二级前导段框架介绍_Crystal_金程教育(标准版).pdf [ 979.80kB ]

| | | | FRM二级前导段框架介绍_Crystal_金程教育(打印版).pdf [ 564.71kB ]

| | | | 1.框架介绍 [ 961.66MB ]

| | | | | 【课时1】FRM二级前导-市场风险.mp4 [ 266.42MB ]

| | | | | 【课时2】FRM二级前导-信用风险.mp4 [ 179.34MB ]

| | | | | 【课时3】FRM二级前导-操作风险.mp4 [ 254.08MB ]

| | | | | 【课时4】FRM二级前导-流动性风险与投资组合管理.mp4 [ 261.83MB ]

| | | 02-基础班 [ 13.39GB ]

| | | | 01【299素材网 网:299sucai.com】【微信号:jzb985】-Market Risk Measurement and Management [ 1.55GB ]

| | | | | 01.Parametric Approaches.mp4 [ 118.80MB ]

| | | | | 02.Non-parametric Approaches.mp4 [ 242.63MB ]

| | | | | 03.Extreme value.mp4 [ 82.35MB ]

| | | | | 04.Backtesting VaR.mp4 [ 153.12MB ]

| | | | | 05.VaR Mapping.mp4 [ 187.35MB ]

| | | | | 06.Risk Measurement for the Trading Book.mp4 [ 142.92MB ]

| | | | | 07.Some Correlation Basics.mp4 [ 157.08MB ]

| | | | | 08.Empirical Properties of Correlation .mp4 [ 32.99MB ]

| | | | | 09.Financial Correlation Modeling .mp4 [ 35.16MB ]

| | | | | 10.Empirical Approaches to Risk Metrics and Hedges .mp4 [ 47.07MB ]

| | | | | 11.The Science of Term Structure Models .mp4 [ 110.48MB ]

| | | | | 12.The Evolution of Short Rates and the Shape of the Term Structure .mp4 [ 36.04MB ]

| | | | | 13.The Art of Term Structure Models Drift & Volatility and Distribution .mp4 [ 151.22MB ]

| | | | | 14.Volatility Smiles .mp4 [ 80.19MB ]

| | | | | 讲义 [ 7.64MB ]

| | | | | | FRM二级基础段市场风险_Crystal_标准版.pdf [ 3.54MB ]

| | | | | | FRM二级基础段市场风险_Crystal_打印版.pdf [ 4.10MB ]

| | | | 02【299素材网 网:299sucai.com】【微信号:jzb985】-Credit Risk Measurement and Management [ 1.89GB ]

| | | | | 01-Fundamentals of Credit Risk and Governance .mp4 [ 138.92MB ]

| | | | | 02-Credit Risk Management .mp4 [ 113.37MB ]

| | | | | 03-Estimating Default Probabilities .mp4 [ 237.49MB ]

| | | | | 04-Credit Value at Risk .mp4 [ 52.90MB ]

| | | | | 05-Capital Structure in Banks .mp4 [ 38.30MB ]

| | | | | 06-Introduction to Credit Risk Modeling and Assessment .mp4 [ 49.47MB ]

| | | | | 07-Credit Scoring and Rating .mp4 [ 55.80MB ]

| | | | | 08-Credit Scoring and Retail Credit Risk Management .mp4 [ 57.91MB ]

| | | | | 09-Credit Risk .mp4 [ 99.99MB ]

| | | | | 10-Credit Derivatives .mp4 [ 128.60MB ]

| | | | | 11-Derivatives .mp4 [ 103.45MB ]

| | | | | 12-Exposure .mp4 [ 42.16MB ]

| | | | | 13-CVA, DVA and BCVA .mp4 [ 164.48MB ]

| | | | | 14-Netting .mp4 [ 38.44MB ]

| | | | | 15-Collateralization and Termination .mp4 [ 84.15MB ]

| | | | | 16-Central Clearing .mp4 [ 86.03MB ]

| | | | | 17-The Evolution of Stress Testing Counterparty Exposures .mp4 [ 40.07MB ]

| | | | | 18-Portfolio Credit Risk .mp4 [ 107.93MB ]

| | | | | 19-Structured Credit Risk and Securitization .mp4 [ 229.51MB ]

| | | | | 20-Country Risk .mp4 [ 53.56MB ]

| | | | | FRM二级基础段信用风险_杨玲琪_标准版.pdf [ 5.19MB ]

| | | | | FRM二级基础段信用风险_杨玲琪_打印版.pdf [ 5.39MB ]

| | | | 03【299素材网 网:299sucai.com】【微信号:jzb985】-Operational Risk and Resiliency [ 2.87GB ]

| | | | | 01.Introduction to Operational Risk and Resilience.mp4 [ 207.18MB ]

| | | | | 02.Risk Governance.mp4 [ 168.47MB ]

| | | | | 03.Risk Identification.mp4 [ 218.48MB ]

| | | | | 04.Risk Assessment Tools.mp4 [ 177.74MB ]

| | | | | 05.Quantitative Risk Measurement.mp4 [ 213.14MB ]

| | | | | 06.Risk Mitigation.mp4 [ 198.28MB ]

| | | | | 07.Risk Reporting.mp4 [ 162.81MB ]

| | | | | 08.Integrated Risk Management.mp4 [ 94.05MB ]

| | | | | 09.Cyber threats and Information Security Risks.mp4 [ 171.41MB ]

| | | | | 10.Financial Crime and Fraud .mp4 [ 92.92MB ]

| | | | | 11.Third-Party Risk Management .mp4 [ 73.28MB ]

| | | | | 12.Investor Protection and Compliance Risks .mp4 [ 41.29MB ]

| | | | | 13.Model Risk and Model Validation .mp4 [ 92.55MB ]

| | | | | 14.Risk-Adjusted Performance Measurement .mp4 [ 180.60MB ]

| | | | | 15.Practices of Economic Capital and Capital Planning .mp4 [ 90.71MB ]

| | | | | 16.Stress testing in Banks .mp4 [ 41.99MB ]

| | | | | 17.Basel I .mp4 [ 175.02MB ]

| | | | | 18.Basel II and Solvency II .mp4 [ 214.60MB ]

| | | | | 19.Basel 2.5 and Basel III .mp4 [ 200.00MB ]

| | | | | 20.Basel III Reforms and finalization .mp4 [ 101.09MB ]

| | | | | 讲义 [ 19.01MB ]

| | | | | | FRM二级基础段操作风险与弹性_Mikey_标准版.pdf [ 7.57MB ]

| | | | | | FRM二级基础段操作风险与弹性_Mikey_打印版.pdf [ 11.44MB ]

| | | | 04【299素材网 网:299sucai.com】【微信号:jzb985】-流动性风险 [ 4.16GB ]

| | | | | Mikey Chow [ 4.16GB ]

| | | | | | FRM二级基础段流动性Mikey金程教育(标准版)_Password_Removed.pdf [ 4.10MB ]

| | | | | | FRM二级基础段流动性Mikey金程教育(打印版)_Password_Removed.pdf [ 1.76MB ]

| | | | | | 【课时10】10.Liquidity Risk Reporting and Stress Testing.mp4 [ 39.18MB ]

| | | | | | 【课时11】11.Contingency Funding Planning.mp4 [ 58.38MB ]

| | | | | | 【课时12】12.Managing and Pricing Deposit Services.mp4 [ 205.92MB ]

| | | | | | 【课时13】13.Managing Nondeposit Liabilities.mp4 [ 259.32MB ]

| | | | | | 【课时14】14.Repurchase Agreements and Financing.mp4 [ 138.80MB ]

| | | | | | 【课时15】15.Liquidity Transfer Pricing A Guide to Better Practic.mp4 [ 136.69MB ]

| | | | | | 【课时16】16.The US Dollar Shortage in Global Banking and the International Policy Respons.mp4 [ 43.80MB ]

| | | | | | 【课时17】17.Interest Parity Lost Understanding the Cross-Currency Basis.mp4 [ 59.16MB ]

| | | | | | 【课时18】18.Risk Management for Changing Interest Rates Asset-Liability Management and D.mp4 [ 257.63MB ]

| | | | | | 【课时19】19.Illiquid Assets.mp4 [ 200.11MB ]

| | | | | | 【课时1】1.Liquidity Risk-1643449020.mp4 [ 504.49MB ]

| | | | | | 【课时2】2.Liquidity and Leverag.mp4 [ 358.17MB ]

| | | | | | 【课时3】3.Early Warning Indicators.mp4 [ 34.46MB ]

| | | | | | 【课时4】4.The Investment Function in Financial-Services Management.mp4 [ 291.62MB ]

| | | | | | 【课时5】5.Liquidity and Reserves Management Strategies and Policies.mp4 [ 679.30MB ]

| | | | | | 【课时6】6.Intraday Liquidity Risk Management.mp4 [ 247.50MB ]

| | | | | | 【课时7】7.Monitoring Liquidity.mp4 [ 512.52MB ]

| | | | | | 【课时8】8.The Failure Mechanics of Dealer Banks.mp4 [ 86.83MB ]

| | | | | | 【课时9】9.Liquidity Stress Testing.mp4 [ 140.39MB ]

| | | | 05【299素材网 网:299sucai.com】【微信号:jzb985】-Risk Management and Investment Management [ 1.75GB ]

| | | | | 01-Factor Theory .mp4 [ 157.81MB ]

| | | | | 02-Factors .mp4 [ 124.25MB ]

| | | | | 03-Alpha (and the Low- Risk Anomaly) .mp4 [ 221.26MB ]

| | | | | 04-Portfolio Construction .mp4 [ 249.40MB ]

| | | | | 05-Portfolio Risk Measures .mp4 [ 187.85MB ]

| | | | | 06-VaR Applications to Different Risks .mp4 [ 115.36MB ]

| | | | | 07-VaR Applications in Investment .mp4 [ 189.83MB ]

| | | | | 08-Portfolio Performance Evaluation .mp4 [ 274.31MB ]

| | | | | 09-Hedge Funds.mp4 [ 167.08MB ]

| | | | | 10-Performing Due Diligence on Specific Managers and Funds.mp4 [ 100.77MB ]

| | | | | FRM二级基础段投资_周琪_标准版.pdf [ 1.84MB ]

| | | | | FRM二级基础段投资_周琪_打印版.pdf [ 1.33MB ]

| | | | 06【299素材网 网:299sucai.com】【微信号:jzb985】-Current Issues [ 1.18GB ]

| | | | | 01-Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank .mp4 [ 150.62MB ]

| | | | | 02-The Credit Suisse CoCo Wipeout .mp4 [ 61.72MB ]

| | | | | 03-Artificial Intelligence and Bank Supervision .mp4 [ 122.91MB ]

| | | | | 04-Financial Risk Management and Explainable, Trustworthy, Responsible AI .mp4 [ 182.81MB ]

| | | | | 05-Artificial Intelligence Risk Management Framework .mp4 [ 169.11MB ]

| | | | | 06-Climate-related risk drivers and their transmission channels .mp4 [ 119.39MB ]

| | | | | 07-Climate-related financial risks – measurement methodologies .mp4 [ 129.44MB ]

| | | | | 08-Principles for the effective mgt. and sup. of climate-related financial risks .mp4 [ 76.14MB ]

| | | | | 09-Digital Resilience and Financial Stability .mp4 [ 175.25MB ]

| | | | | 讲义 [ 17.70MB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_01_标准版.pdf [ 1.33MB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_01_打印版.pdf [ 2.80MB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_02_标准版.pdf [ 553.75kB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_02_打印版.pdf [ 658.85kB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_06_标准版.pdf [ 854.86kB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_06_打印版.pdf [ 1.32MB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_07_标准版.pdf [ 1.58MB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_07_打印版.pdf [ 2.38MB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_08_标准版.pdf [ 525.28kB ]

| | | | | | FRM二级基础段金融热点话题_姚奕_08_打印版.pdf [ 332.80kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_03_标准版.pdf [ 370.40kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_03_打印版.pdf [ 261.02kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_04_标准版.pdf [ 502.87kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_04_打印版.pdf [ 494.34kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_05_标准版.pdf [ 982.19kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_05_打印版.pdf [ 1.24MB ]

| | | | | | FRM二级基础段金融热点话题_周琪_09_标准版.pdf [ 927.68kB ]

| | | | | | FRM二级基础段金融热点话题_周琪_09_打印版.pdf [ 760.67kB ]

| | | 03-强化班 [ 2.83GB ]

| | | | 01【299素材网 网:299sucai.com】【微信号:jzb985】.Market Risk Measurement and Management [ 805.88MB ]

| | | | | 01.Estimating Market Risk Measures .mp4 [ 190.37MB ]

| | | | | 02.Extreme value.mp4 [ 43.72MB ]

| | | | | 03.Backtesting VaR .mp4 [ 98.25MB ]

| | | | | 04.VaR Mapping .mp4 [ 110.98MB ]

| | | | | 05.Risk Measurement for the Trading Book.mp4 [ 45.13MB ]

| | | | | 06.Modeling Dependence Correlations And Copulas .mp4 [ 98.74MB ]

| | | | | 07.Empirical Approaches to Risk Metrics and Hedges.mp4 [ 15.75MB ]

| | | | | 08.Term Structure Models of Interest Rates .mp4 [ 157.76MB ]

| | | | | 09.Volatility Smiles.mp4 [ 43.22MB ]

| | | | | 讲义 [ 1.96MB ]

| | | | | | FRM二级强化段_市场风险测量与管理_Crytal_标准版.pdf [ 1.28MB ]

| | | | | | FRM二级强化段_市场风险测量与管理_Crytal_打印版.pdf [ 694.67kB ]

| | | | 02【299素材网 网:299sucai.com】【微信号:jzb985】.Operational Risk and Resiliency [ 854.23MB ]

| | | | | 01.Risk management framework .mp4 [ 140.69MB ]

| | | | | 02.Risk Identification and assessment tools .mp4 [ 120.37MB ]

| | | | | 03.Quantitative risk measurement.mp4 [ 46.92MB ]

| | | | | 04.Risk mitagation and reporting .mp4 [ 92.68MB ]

| | | | | 05.Cyber threats ,financial crime and third-party management .mp4 [ 125.67MB ]

| | | | | 06.Invester Protection and Model risk.mp4 [ 82.52MB ]

| | | | | 07.Capital planning .mp4 [ 109.89MB ]

| | | | | 08.The Basel Accord .mp4 [ 127.05MB ]

| | | | | 讲义 [ 8.44MB ]

| | | | | | FRM二级强化段操作风险_Mikey_标准版.pdf [ 3.66MB ]

| | | | | | FRM二级强化段操作风险_Mikey_打印版.pdf [ 4.78MB ]

| | | | 03【299素材网 网:299sucai.com】【微信号:jzb985】.Liquidity and Treasury Risk Measurement and Management [ 647.80MB ]

| | | | | 01.Identify and Understand Liquidity .mp4 [ 215.75MB ]

| | | | | 02.Manage Liquidity Risk .mp4 [ 153.09MB ]

| | | | | 03.Asset Management and Liability Management .mp4 [ 124.17MB ]

| | | | | 04.Measure and Monitor Liquidity Risk.mp4 [ 63.28MB ]

| | | | | 05.Interest Risk and Liquidity Phenomenon .mp4 [ 88.30MB ]

| | | | | 讲义 [ 3.21MB ]

| | | | | | FRM二级强化段_流动性风险测量与管理_Mikey_标准版.pdf [ 2.18MB ]

| | | | | | FRM二级强化段_流动性风险测量与管理_Mikey_打印版.pdf [ 1.03MB ]

| | | | 04【299素材网 网:299sucai.com】【微信号:jzb985】.Risk Management and Investment Management [ 587.30MB ]

| | | | | 01.Factor Investing .mp4 [ 176.76MB ]

| | | | | 02.Portfolio Construction .mp4 [ 117.64MB ]

| | | | | 03.Expand Portfolio Risk Management .mp4 [ 146.63MB ]

| | | | | 04.Hedge Funds .mp4 [ 144.62MB ]

| | | | | 0.讲义 [ 1.66MB ]

| | | | | | FRM二级强化段_风险管理与投资管理_吴帆_标准版.pdf [ 1,008.79kB ]

| | | | | | FRM二级强化段_风险管理与投资管理_吴帆_打印版.pdf [ 694.69kB ]

| | frm二级高顿gd [ 26.55GB ]

| | | 02-基础班 [ 21.65GB ]

| | | | 1【299素材网 网:299sucai.com】【微信号:jzb985】.投资管理与风险管理 [ 6.32GB ]

| | | | | 01-Introduction.mp4 [ 585.35MB ]

| | | | | 02-factor theory and CAPM (1).mp4 [ 248.33MB ]

| | | | | 03-factor theory and CAPM (2).mp4 [ 139.20MB ]

| | | | | 04-multifactor and EMH.mp4 [ 198.87MB ]

| | | | | 05-macro factors.mp4 [ 270.77MB ]

| | | | | 06-dynamic factors.mp4 [ 352.76MB ]

| | | | | 07-active management.mp4 [ 186.96MB ]

| | | | | 08-benchmarker matters.mp4 [ 410.12MB ]

| | | | | 09-inputs for portfolio construction(1).mp4 [ 318.28MB ]

| | | | | 10-inputs for portfolio construction(2).mp4 [ 154.53MB ]

| | | | | 11-portfolio construction techniques.mp4 [ 174.90MB ]

| | | | | 12-portfolio VaR measures.mp4 [ 416.57MB ]

| | | | | 13-using VaR for risk management.mp4 [ 207.92MB ]

| | | | | 14-specific risks in investment management(1).mp4 [ 237.71MB ]

| | | | | 15-specific risks in investment management(2).mp4 [ 211.37MB ]

| | | | | 16-risk budgeting(1).mp4 [ 111.37MB ]

| | | | | 17-risk budgeting(2).mp4 [ 162.47MB ]

| | | | | 18-three-legged risk management stool.mp4 [ 65.16MB ]

| | | | | 19-RMUs&performance measurement.mp4 [ 84.69MB ]

| | | | | 20-conventional theory(1).mp4 [ 254.33MB ]

| | | | | 21-conventional theory(2).mp4 [ 163.08MB ]

| | | | | 22-market timing.mp4 [ 151.39MB ]

| | | | | 23-performance attribution.mp4 [ 196.63MB ]

| | | | | 24-characteristics of hedge funds.mp4 [ 234.29MB ]

| | | | | 25-hedge funds strategies(1).mp4 [ 166.53MB ]

| | | | | 26-hedge funds strategies(1).mp4 [ 235.47MB ]

| | | | | 27-risks in hedge funds.mp4 [ 79.03MB ]

| | | | | 28-performing due diligence on specific managers and funds.mp4 [ 243.48MB ]

| | | | | 29-finding bernie madoff detecting fraud by investment managers.mp4 [ 210.95MB ]

| | | | 2【299素材网 网:299sucai.com】【微信号:jzb985】.市场风险测量与管理 [ 2.89GB ]

| | | | | 01-Introduction to Market Risk Measurement and Management.mp4 [ 23.61MB ]

| | | | | 02-Parametric Approach(1).mp4 [ 37.04MB ]

| | | | | 03-Parametric Approach(2).mp4 [ 23.82MB ]

| | | | | 04-Expected Shortfall and Risk Measures .mp4 [ 117.35MB ]

| | | | | 05-Historical Simulation .mp4 [ 91.66MB ]

| | | | | 06-Weighted Historical Simulation(1) .mp4 [ 124.07MB ]

| | | | | 07-Weighted Historical Simulation(2) .mp4 [ 141.17MB ]

| | | | | 08-Generalized extreme-value (GEV).mp4 [ 37.26MB ]

| | | | | 09-Generalized extreme-value (GEV).mp4 [ 37.26MB ]

| | | | | 10-Peaks-over-threshold (POT) 01 .mp4 [ 109.99MB ]

| | | | | 10-Peaks-over-threshold (POT) 02 .mp4 [ 5.90MB ]

| | | | | 12-Model Validation(1).mp4 [ 31.26MB ]

| | | | | 13-Model Validation(2) .mp4 [ 177.56MB ]

| | | | | 14-Basel Rules.mp4 [ 30.51MB ]

| | | | | 15-Basis of VaR Mapping.mp4 [ 40.19MB ]

| | | | | 16-Methods of VaR mapping (1) .mp4 [ 100.61MB ]

| | | | | 17-Methods of VaR mapping (2) .mp4 [ 102.58MB ]

| | | | | 18-Methods of VaR mapping (3).mp4 [ 15.99MB ]

| | | | | 19-Application of VaR Mapping.mp4 [ 36.97MB ]

| | | | | 20-Correlation Basics(1).mp4 [ 41.01MB ]

| | | | | 21-Correlation Basics(2) .mp4 [ 175.02MB ]

| | | | | 22-Correlation Basics(3).mp4 [ 36.51MB ]

| | | | | 23-Correlation Basics(4).mp4 [ 23.96MB ]

| | | | | 24-Empirical Properties of Correlation(1) .mp4 [ 155.40MB ]

| | | | | 25-Empirical Properties of Correlation(2).mp4 [ 31.14MB ]

| | | | | 26-Financial Correlation Modeling .mp4 [ 154.03MB ]

| | | | | 27-Asset Valuation with Binomial Interest Rate Tree (1).mp4 [ 33.20MB ]

| | | | | 28-Asset Valuation with Binomial Interest Rate Tree (2) .mp4 [ 129.64MB ]

| | | | | 30-Issues with Interest Rate Tree Model .mp4 [ 44.39MB ]

| | | | | 31-The Evolution of Short Rates and the Shape of the Term Structure(1).mp4 [ 31.94MB ]

| | | | | 32-The Evolution of Short Rates and the Shape of the Term Structure(2).mp4 [ 35.49MB ]

| | | | | 33-The Evolution of Short Rates and the Shape of the Term Structure(3).mp4 [ 28.71MB ]

| | | | | 34-Model 1 .mp4 [ 58.28MB ]

| | | | | 35-Model 2.mp4 [ 27.13MB ]

| | | | | 36-Ho-Lee Model .mp4 [ 49.78MB ]

| | | | | 37-Vasicek Model(1).mp4 [ 42.13MB ]

| | | | | 38-Vasicek Model(2) .mp4 [ 40.50MB ]

| | | | | 39-The Art of Term Structure Models Volatility and Distribution(1).mp4 [ 38.74MB ]

| | | | | 40-The Art of Term Structure Models Volatility and Distribution(2) .mp4 [ 45.61MB ]

| | | | | 41-The Art of Term Structure Model – Summary.mp4 [ 13.52MB ]

| | | | | 42-Messages from the Academic Literature on Risk Measurement for the Trading Book(1) .mp4 [ 46.77MB ]

| | | | | 43-Messages from the Academic Literature on Risk Measurement for the Trading Book(2) .mp4 [ 41.60MB ]

| | | | | 44-Messages from the Academic Literature on Risk Measurement for the Trading Book(3) .mp4 [ 67.00MB ]

| | | | | 45-Fundamental Review of Trading Book(1).mp4 [ 37.13MB ]

| | | | | 46-Fundamental Review of Trading Book(2).mp4 [ 38.91MB ]

| | | | | 47-Empirical Approaches to Risk Metrics and Hedges(1) .mp4 [ 57.17MB ]

| | | | | 48-Empirical Approaches to Risk Metrics and Hedges(2).mp4 [ 39.75MB ]

| | | | | 49-Volatility Smiles (1).mp4 [ 34.56MB ]

| | | | | 50-Volatility Smiles (2).mp4 [ 27.91MB ]

| | | | | 51-Volatility Smiles (3) .mp4 [ 48.16MB ]

| | | | 3【299素材网 网:299sucai.com】【微信号:jzb985】.操作与综合风险 [ 5.85GB ]

| | | | | 02-Definition and Types of Operational Risk (1).mp4 [ 82.86MB ]

| | | | | 03-Definition and Types of Operational Risk (2).mp4 [ 69.48MB ]

| | | | | 04-Characteristics of Operational Risk.mp4 [ 51.18MB ]

| | | | | 05-Operational Risk Management Framework.mp4 [ 61.71MB ]

| | | | | 06-Operational Resilience .mp4 [ 52.14MB ]

| | | | | 07-BCBS Principle for Sound ORM .mp4 [ 87.53MB ]

| | | | | 08-Committee Structure and Three Lines of Defense Model.mp4 [ 66.92MB ]

| | | | | 09-Risk Appetite .mp4 [ 101.93MB ]

| | | | | 10-Risk Culture .mp4 [ 83.14MB ]

| | | | | 11-Top-down.mp4 [ 77.06MB ]

| | | | | 12-Bottom-up.mp4 [ 59.13MB ]

| | | | | 13-Scenario Analysis and Risk Taxonomy .mp4 [ 85.04MB ]

| | | | | 14-Incident Database .mp4 [ 137.62MB ]

| | | | | 15-Qualitative Risk Assessment .mp4 [ 138.66MB ]

| | | | | 16-Quantitative Risk Assessment .mp4 [ 98.21MB ]

| | | | | 17-Operational Risk Modeling and Capital.mp4 [ 60.73MB ]

| | | | | 18-Quantification of Operational Resilience.mp4 [ 55.26MB ]

| | | | | 19-Internal Control Types .mp4 [ 47.08MB ]

| | | | | 20-Control Design and Testing.mp4 [ 53.50MB ]

| | | | | 21-Risk Mitigation by Process Design .mp4 [ 98.72MB ]

| | | | | 22-New Product Approval Process.mp4 [ 44.26MB ]

| | | | | 23-Mitigation Measures to Reduce Impact.mp4 [ 56.63MB ]

| | | | | 24-Risk transfer.mp4 [ 58.79MB ]

| | | | | 25-Management of Reputational Risk.mp4 [ 35.44MB ]

| | | | | 26-Roles and Responsibilities of Committees .mp4 [ 93.58MB ]

| | | | | 27-Seven Elements of Internal ORM Report .mp4 [ 82.11MB ]

| | | | | 28-Characteristics and Challenges of Operational Risk Data .mp4 [ 76.91MB ]

| | | | | 29-External Risk Reporting.mp4 [ 59.60MB ]

| | | | | 30-ERM Framework.mp4 [ 56.62MB ]

| | | | | 31-Risk Capital.mp4 [ 60.09MB ]

| | | | | 32-Stress Testing .mp4 [ 88.92MB ]

| | | | | 33-Cyber-resilience Range of Practice (1).mp4 [ 71.14MB ]

| | | | | 34-Cyber-resilience Range of Practice (2) .mp4 [ 80.88MB ]

| | | | | 35-Case Study Cyberthreats and Information Security Risk (1).mp4 [ 61.12MB ]

| | | | | 36-Case Study Cyberthreats and Information Security Risk (2) .mp4 [ 77.79MB ]

| | | | | 37-Case Study Cyberthreats and Information Security Risk (3).mp4 [ 55.24MB ]

| | | | | 38-Sound Management of Risks Related to Money Laundering and Financing of Terrorism .mp4 [ 42.35MB ]

| | | | | 39-Elements of Control Framework .mp4 [ 97.02MB ]

| | | | | 40-Case study USAA.mp4 [ 36.89MB ]

| | | | | 41-Guidance on Managing Outsourcing Risk .mp4 [ 55.49MB ]

| | | | | 42-Case study Third-party Risk Management .mp4 [ 90.37MB ]

| | | | | 43-Case study Investor Protection and Compliance Risks(1).mp4 [ 83.65MB ]

| | | | | 44-Case study Investor Protection and Compliance Risks(2).mp4 [ 31.85MB ]

| | | | | 45-Supervisory Guidance on Model Risk Management (1) .mp4 [ 103.34MB ]

| | | | | 46-Supervisory Guidance on Model Risk Management (2).mp4 [ 64.08MB ]

| | | | | 47-Case Study Model Risk and Model Validation .mp4 [ 115.79MB ]

| | | | | 48-Risk Capital Attribution and Risk-Adjusted Performance Measurement(1).mp4 [ 58.12MB ]

| | | | | 49-Risk Capital Attribution and Risk-Adjusted Performance Measurement(2).mp4 [ 35.49MB ]

| | | | | 50-Risk Capital Attribution and Risk-Adjusted Performance Measurement (3).mp4 [ 26.32MB ]

| | | | | 51-Range of Practices and Issues in Economic Capital Frameworks (1).mp4 [ 55.44MB ]

| | | | | 52-Range of Practices and Issues in Economic Capital Frameworks (2).mp4 [ 30.58MB ]

| | | | | 53-Capital Planning at Large Bank Holding Companies.mp4 [ 73.49MB ]

| | | | | 54-Stress Testing Banks.mp4 [ 51.08MB ]

| | | | | 55-Basel I.mp4 [ 169.21MB ]

| | | | | 56-Basel I Amendments(1).mp4 [ 62.54MB ]

| | | | | 57-Basel I Amendments(2).mp4 [ 81.69MB ]

| | | | | 58-Basel II(1) .mp4 [ 125.84MB ]

| | | | | 59-Basel II(2) .mp4 [ 157.37MB ]

| | | | | 60-Basel II(3) .mp4 [ 175.18MB ]

| | | | | 61-Basel II(4) .mp4 [ 71.29MB ]

| | | | | 62-Basel Ⅱ.5 (1).mp4 [ 91.15MB ]

| | | | | 63-Basel Ⅱ.5 (2).mp4 [ 99.33MB ]

| | | | | 64-Capital Requirements (1).mp4 [ 114.82MB ]

| | | | | 65-Capital-Requirements (2).mp4 [ 118.47MB ]

| | | | | 66-Capital-Requirements (3).mp4 [ 101.83MB ]

| | | | | 67-Liquidity Risk.mp4 [ 129.90MB ]

| | | | | 68-CCR and Regulation after GFC.mp4 [ 46.24MB ]

| | | | | 69-Motivations for Revising the Basel Ⅲ Framework.mp4 [ 93.46MB ]

| | | | | 70-Revision for Credit Risk.mp4 [ 114.92MB ]

| | | | | 71-CVA risk and Operational Risk Framework.mp4 [ 23.93MB ]

| | | | | 72-Leverage Ratio Framework and Output Floor.mp4 [ 104.66MB ]

| | | | | 73-Standardized Measurement Approach.mp4 [ 137.95MB ]

| | | | | 74-General and Specific Criteria.mp4 [ 127.78MB ]

| | | | | 75-FRTB-1.mp4 [ 51.73MB ]

| | | | | 76-FRTB-2.mp4 [ 109.34MB ]

| | | | 4【299素材网 网:299sucai.com】【微信号:jzb985】.信用风险测量与管理 [ 4.08GB ]

| | | | | 01-introduction 471.mp4 [ 38.38MB ]

| | | | | 02-review.mp4 [ 10.36MB ]

| | | | | 03-What is credit risk .mp4 [ 31.22MB ]

| | | | | 04-Transactions and entities .mp4 [ 43.87MB ]

| | | | | 05-Governance .mp4 [ 48.01MB ]

| | | | | 06-Major development for credit risk management.mp4 [ 25.98MB ]

| | | | | 07-Credit risk assessment approaches .mp4 [ 36.85MB ]

| | | | | 08-External ratings (1).mp4 [ 29.12MB ]

| | | | | 09-External ratings (2).mp4 [ 29.25MB ]

| | | | | 10-Internal ratings .mp4 [ 42.03MB ]

| | | | | 11-Probability of default .mp4 [ 46.46MB ]

| | | | | 12-Probability of default – Migration matrix .mp4 [ 51.04MB ]

| | | | | 13-Using hazard rate to estimate default probabilities.mp4 [ 35.48MB ]

| | | | | 14-Spread and hazard rate .mp4 [ 53.08MB ]

| | | | | 15-Spread and hazard rate – Matching bond prices .mp4 [ 54.16MB ]

| | | | | 16-Comparison of Default Probability Estimates.mp4 [ 33.22MB ]

| | | | | 17-Merton model (1).mp4 [ 36.09MB ]

| | | | | 18-Merton model (2) .mp4 [ 62.07MB ]

| | | | | 19-Further discussion and KMV model .mp4 [ 46.84MB ]

| | | | | 20-Retail Credit Risk.mp4 [ 36.83MB ]

| | | | | 21-Credit Scoring .mp4 [ 53.27MB ]

| | | | | 22-Sources of Country Risk.mp4 [ 38.93MB ]

| | | | | 23-Sovereign Default Risk.mp4 [ 31.94MB ]

| | | | | 24-Sovereign Default Risk – measures .mp4 [ 48.78MB ]

| | | | | 25-Expected loss and unexpected loss (1).mp4 [ 35.87MB ]

| | | | | 26-Expected loss and unexpected loss (2) .mp4 [ 46.98MB ]

| | | | | 27-Credit loss distribution and capital.mp4 [ 27.71MB ]

| | | | | 28-Default correlation.mp4 [ 35.56MB ]

| | | | | 29-Credit VaR (1) .mp4 [ 50.37MB ]

| | | | | 30-Credit VaR (2).mp4 [ 33.34MB ]

| | | | | 31-Single factor model – Gaussian copula.mp4 [ 29.81MB ]

| | | | | 32-Single factor model – Model.mp4 [ 37.77MB ]

| | | | | 33-Single factor model – Conditional default distribution.mp4 [ 34.71MB ]

| | | | | 34-Vasicek model .mp4 [ 43.41MB ]

| | | | | 35-CreditMetrics – Intro .mp4 [ 40.11MB ]

| | | | | 36-CreditMetrics – Sampling.mp4 [ 26.99MB ]

| | | | | 37-CreditMetrics – Credit Spread Risk.mp4 [ 36.83MB ]

| | | | | 38-Credit risk plus.mp4 [ 26.80MB ]

| | | | | 39-Derivatives market – review.mp4 [ 38.22MB ]

| | | | | 40-Derivatives market – participants and collateral .mp4 [ 124.08MB ]

| | | | | 41-Derivatives market – ISDA.mp4 [ 34.88MB ]

| | | | | 42-CCP and modeling derivatives risk (1).mp4 [ 37.42MB ]

| | | | | 43-CCP and modeling derivatives risk (2).mp4 [ 30.52MB ]

| | | | | 44-Counterparty Risk.mp4 [ 40.35MB ]

| | | | | 45-Cash flow netting.mp4 [ 21.57MB ]

| | | | | 46-Cash flow netting – Portfolio compression.mp4 [ 34.12MB ]

| | | | | 47Value netting – Close-out netting.mp4 [ 30.13MB ]

| | | | | 48-Value netting – netting impact.mp4 [ 46.01MB ]

| | | | | 49-Margin term (1).mp4 [ 36.87MB ]

| | | | | 50-Margin term (2) .mp4 [ 139.89MB ]

| | | | | 51-Impact of margin (1).mp4 [ 38.53MB ]

| | | | | 52-Impact of margin (2).mp4 [ 28.05MB ]

| | | | | 53-CCP risk management – The Loss Waterfall .mp4 [ 151.18MB ]

| | | | | 54-Evolution and mechanics.mp4 [ 35.57MB ]

| | | | | 55-CCP risk management.mp4 [ 36.26MB ]

| | | | | 56-Metrics for Credit Exposure (1).mp4 [ 37.23MB ]

| | | | | 57-Metrics for Credit Exposure (2).mp4 [ 33.67MB ]

| | | | | 58-Exposure profile of various securities .mp4 [ 126.07MB ]

| | | | | 59-The impacts on exposure.mp4 [ 66.44MB ]

| | | | | 60-Credit Valuation Adjustment and xVA (1) .mp4 [ 114.37MB ]

| | | | | 61-Credit Valuation Adjustment and xVA (2).mp4 [ 13.34MB ]

| | | | | 62-Unilateral CVA .mp4 [ 123.51MB ]

| | | | | 63-DVA and BCVA .mp4 [ 138.93MB ]

| | | | | 64-DVA and BCVA – 特别说明.mp4 [ 25.73MB ]

| | | | | 65-CVA allocation.mp4 [ 40.30MB ]

| | | | | 66-Wrong-way risk (1) .mp4 [ 126.48MB ]

| | | | | 67-Wrong-way risk (2).mp4 [ 34.93MB ]

| | | | | 68-Stress Testing.mp4 [ 30.57MB ]

| | | | | 69-Policies and actions.mp4 [ 38.86MB ]

| | | | | 70-Loan loss provisioning.mp4 [ 35.94MB ]

| | | | | 72-Credit Default Swap – The CDS spread.mp4 [ 43.10MB ]

| | | | | 73-Credit Default Swap – others.mp4 [ 43.30MB ]

| | | | | 74-Total return swap.mp4 [ 30.67MB ]

| | | | | 75-CDO – Synthetic CDO.mp4 [ 35.44MB ]

| | | | | 76-CDO – implied correlation .mp4 [ 124.87MB ]

| | | | | 77-The Process of Securitization.mp4 [ 46.57MB ]

| | | | | 78-Asset pools (1).mp4 [ 32.14MB ]

| | | | | 80-Structured products .mp4 [ 120.91MB ]

| | | | | 81-Structured products – Impact of PD and Default Correlation .mp4 [ 133.20MB ]

| | | | | 82-Cash flows in Securitization Structure – basic.mp4 [ 40.81MB ]

| | | | | 83-Cash flows in Securitization Structure – interim cashflows .mp4 [ 134.35MB ]

| | | | | 84-Cash flows in Securitization Structure – final cashflows.mp4 [ 34.16MB ]

| | | | 5【299素材网 网:299sucai.com】【微信号:jzb985】.流动性风险 [ 1.91GB ]

| | | | | 01-introduction.mp4 [ 30.42MB ]

| | | | | 02-introduction of liquidity risk .mp4 [ 120.39MB ]

| | | | | 03-Liquidity challenges .mp4 [ 49.06MB ]

| | | | | 04-Collateral and Leverage .mp4 [ 42.48MB ]

| | | | | 05-Deposit Services Introduction .mp4 [ 49.90MB ]

| | | | | 06-Deposits Pricing Methods .mp4 [ 75.98MB ]

| | | | | 07-Non-deposit Liabilities Sources.mp4 [ 38.91MB ]

| | | | | 08-Non-deposit Funding Choice.mp4 [ 31.05MB ]

| | | | | 09-Overall Cost Of Fund.mp4 [ 28.11MB ]

| | | | | 10-Repo transaction basis .mp4 [ 72.91MB ]

| | | | | 11-Special collateral in repo.mp4 [ 35.33MB ]

| | | | | 12-Investment instruments .mp4 [ 78.26MB ]

| | | | | 13-The failure of dealer banks .mp4 [ 58.71MB ]

| | | | | 14-Maturity strategies and management tools .mp4 [ 48.60MB ]

| | | | | 15-Illiquid markets.mp4 [ 16.07MB ]

| | | | | 16-Illiquid assets bias.mp4 [ 36.50MB ]

| | | | | 17-Asset liability management.mp4 [ 10.88MB ]

| | | | | 18-Interest-Sensitive Gap management .mp4 [ 42.57MB ]

| | | | | 19-Duration Gap management.mp4 [ 36.06MB ]

| | | | | 20-Liquidity management .mp4 [ 120.99MB ]

| | | | | 21-Legal reserve management.mp4 [ 25.81MB ]

| | | | | 22-Liquidity options.mp4 [ 23.50MB ]

| | | | | 23-Term structures for monitoring liquidity .mp4 [ 80.54MB ]

| | | | | 24-Liquidity transfer pricing practice .mp4 [ 44.51MB ]

| | | | | 25-LTP approaches and contigent liquidity risk pricing .mp4 [ 74.48MB ]

| | | | | 26-Cross-currency basis.mp4 [ 34.85MB ]

| | | | | 27-Cause of CIP volation.mp4 [ 32.86MB ]

| | | | | 28-US dollar shortage.mp4 [ 31.55MB ]

| | | | | 29-Framework of EWI.mp4 [ 2.84MB ]

| | | | | 30-Guidance of EWI.mp4 [ 43.67MB ]

| | | | | 31-Basic of Intraday liquidity .mp4 [ 91.61MB ]

| | | | | 32-Intraday liquidity management .mp4 [ 90.17MB ]

| | | | | 33-Introduction of liquidity risk reporting.mp4 [ 29.85MB ]

| | | | | 34-Different types of liquidity risk reports .mp4 [ 86.76MB ]

| | | | | 35-Four categories of funding liquidity.mp4 [ 43.82MB ]

| | | | | 36-Design of the model .mp4 [ 80.33MB ]

| | | | | 37-Liquidity stress test report.mp4 [ 28.52MB ]

| | | | | 38-Considerations of CFP.mp4 [ 43.31MB ]

| | | | | 39-Frameworks of CFP .mp4 [ 48.74MB ]

| | | | 讲义 [ 607.62MB ]

| | | | | 讲义 [ 607.62MB ]

| | | | | | 操作风险与弹性-精讲阶段讲义 -Session1-2.pdf [ 82.57MB ]

| | | | | | 操作风险与弹性-精讲阶段讲义 -Session3-4.pdf [ 65.43MB ]

| | | | | | 流动性风险-精讲阶段讲义(上).pdf [ 57.97MB ]

| | | | | | 流动性风险-精讲阶段讲义(下).pdf [ 64.51MB ]

| | | | | | 市场风险计量与管理(上)-精讲阶段讲义 -Session 1-2.pdf [ 44.02MB ]

| | | | | | 市场风险计量与管理(下)-精讲阶段讲义 -Session-3-4.pdf [ 48.84MB ]

| | | | | | 投资管理与风险管理-精讲阶段讲义.pdf [ 69.08MB ]

| | | | | | 信用风险-精讲阶段讲义(1).pdf [ 87.61MB ]

| | | | | | 信用风险-精讲阶段讲义(2).pdf [ 87.61MB ]

| | | 03-复习阶段 [ 4.46GB ]

| | | | 操作风险与弹性【299素材网 网:299sucai.com】【微信号:jzb985】-复习阶段讲义.pdf [ 46.95MB ]

| | | | 流动性风险复习课讲义【299素材网 网:299sucai.com】【微信号:jzb985】-2024.pdf [ 41.25MB ]

| | | | 市场风险管理复习课讲义【299素材网 网:299sucai.com】【微信号:jzb985】-2024.pdf [ 40.59MB ]

| | | | 投资管理复习课讲义【299素材网 网:299sucai.com】【微信号:jzb985】-2024.pdf [ 26.03MB ]

| | | | 01【299素材网 网:299sucai.com】【微信号:jzb985】-市场风险测量与管理 [ 520.68MB ]

| | | | | 01-Introduction to Market Risk Measurement and Management.mp4 [ 12.64MB ]

| | | | | 02-Estimating Market Risk Measures An Introduction and Overview .mp4 [ 62.24MB ]

| | | | | 03-Non-parametric Approaches(1).mp4 [ 26.21MB ]

| | | | | 04-Non-parametric Approaches(2) .mp4 [ 49.25MB ]

| | | | | 05-Parametric Approaches Extreme Value .mp4 [ 51.37MB ]

| | | | | 06-Backtesting VaR .mp4 [ 60.28MB ]

| | | | | 07-VaR Mapping(1).mp4 [ 11.87MB ]

| | | | | 08-VaR Mapping(2) .mp4 [ 66.29MB ]

| | | | | 09-Correlation Basics Definitions, Applications, and Terminology (1) .mp4 [ 45.11MB ]

| | | | | 10-Correlation Basics Definitions, Applications, and Terminology (2)(1).mp4 [ 36.98MB ]

| | | | | 10-Correlation Basics Definitions, Applications, and Terminology (2).mp4 [ 36.98MB ]

| | | | | 11-Empirical Properties of Correlation.mp4 [ 32.62MB ]

| | | | | 12-Financial Correlation Modeling Bottom-Up Approaches.mp4 [ 28.84MB ]

| | | | 02【299素材网 网:299sucai.com】【微信号:jzb985】-风险管理与投资管理 [ 1.06GB ]

| | | | | 01-Introduction.mp4 [ 41.45MB ]

| | | | | 02-Factor Theory .mp4 [ 116.97MB ]

| | | | | 03-Factors.mp4 [ 64.01MB ]

| | | | | 04-Alpha (and the Low-Risk Anomaly) .mp4 [ 141.85MB ]

| | | | | 05-Portfolio Construction .mp4 [ 152.65MB ]

| | | | | 06-Portfolio Risk :Analytical Methods .mp4 [ 143.94MB ]

| | | | | 07-VaR and Risk Budgeting in Investment Management .mp4 [ 123.00MB ]

| | | | | 08-Risk Monitoring and Performance Measurement.mp4 [ 27.09MB ]

| | | | | 09-Portfolio Performance Evaluation .mp4 [ 127.89MB ]

| | | | | 10-Hedge Funds .mp4 [ 130.56MB ]

| | | | | 11-Performing Due diligence on Specific Managers and Funds.mp4 [ 20.47MB ]

| | | | 03【299素材网 网:299sucai.com】【微信号:jzb985】-流动性风险 [ 741.19MB ]

| | | | | 01-Introduction 274.mp4 [ 49.32MB ]

| | | | | 02-Liquidity risk and leverage .mp4 [ 85.78MB ]

| | | | | 03-Managing deposit services and non-deposit liabilities (1) .mp4 [ 49.70MB ]

| | | | | 04-Managing deposit services and non-deposit liabilities (2) .mp4 [ 46.45MB ]

| | | | | 05-Repos and financing .mp4 [ 43.20MB ]

| | | | | 06-The investment and dealer function in financial-services management .mp4 [ 73.88MB ]

| | | | | 07-Llliquid asset.mp4 [ 26.92MB ]

| | | | | 08-Risk management for changing lnterest rates.mp4 [ 46.39MB ]

| | | | | 09-Liquidity and reserves management strategies and policies.mp4 [ 42.39MB ]

| | | | | 10-Monitoring liquidity.mp4 [ 30.50MB ]

| | | | | 11-Liquidity transfer pricing.mp4 [ 42.69MB ]

| | | | | 12-US dollar shortage and CIP lost.mp4 [ 44.25MB ]

| | | | | 13-Early warning indicator .mp4 [ 45.42MB ]

| | | | | 15-Liquidity risk report.mp4 [ 42.73MB ]

| | | | | 16-Liquidity stress testing and reporting .mp4 [ 52.30MB ]

| | | | | 17-Contigent funding plan .mp4 [ 19.29MB ]

| | | | 04【299素材网 网:299sucai.com】【微信号:jzb985】-操作风险 [ 2.01GB ]

| | | | | 01-Overview of Operational Risk.mp4 [ 33.75MB ]

| | | | | 02-Introduction to Operational Risk and Resilience .mp4 [ 130.78MB ]

| | | | | 03-Risk Identification .mp4 [ 97.00MB ]

| | | | | 04-Risk Governance .mp4 [ 93.88MB ]

| | | | | 05-Risk Measurement and Assessment (1) .mp4 [ 91.56MB ]

| | | | | 06-Risk Measurement and Assessment (2) .mp4 [ 68.98MB ]

| | | | | 07-Risk Mitigation .mp4 [ 132.82MB ]

| | | | | 08-Risk Reporting(1).mp4 [ 58.18MB ]

| | | | | 09-Risk Reporting(2) .mp4 [ 76.98MB ]

| | | | | 10-Intergrated Risk Management .mp4 [ 87.20MB ]

| | | | | 11-Cyber-Resilience Range of Practices.mp4 [ 44.08MB ]

| | | | | 12-Case Study Cyberthreats and Information Security Risk .mp4 [ 79.40MB ]

| | | | | 13-Sound Management of Risks Related to Money Laundering and Financing of Terrorism.mp4 [ 32.75MB ]

| | | | | 14-Case Study Financial Crime and Fraud .mp4 [ 95.84MB ]

| | | | | 15-Guidance on Managing Outsourcing Risk.mp4 [ 26.21MB ]

| | | | | 16-Case Study Third-party Risk Management.mp4 [ 37.71MB ]

| | | | | 17-Case Study Investor Protection and Compliance Risks .mp4 [ 74.42MB ]

| | | | | 18-Supervisory Guidance on Model Risk Management.mp4 [ 33.40MB ]

| | | | | 19-Case Study Model Risk and Model Validation.mp4 [ 62.52MB ]

| | | | | 20-Risk Capital Attribution and Risk-Adjusted Performance Measurement.mp4 [ 53.62MB ]

| | | | | 21-Range of Practices and Issues in Economic Capital Frameworks.mp4 [ 31.47MB ]

| | | | | 22-Capital Planning at Large Bank Holding Companies.mp4 [ 27.40MB ]

| | | | | 23-Stress Testing Banks.mp4 [ 17.73MB ]

| | | | | 24-Basel I and its Amendments .mp4 [ 100.91MB ]

| | | | | 25-Basel II(1).mp4 [ 57.19MB ]

| | | | | 26-Basel II(2).mp4 [ 13.10MB ]

| | | | | 27-Basel II.5.mp4 [ 58.20MB ]

| | | | | 28-Basel III (1) .mp4 [ 70.58MB ]

| | | | | 29-Basel III (2) .mp4 [ 64.43MB ]

| | | | | 30-High-Level Summary of Basel III Reform .mp4 [ 65.84MB ]

| | | | | 31-Basel III Finalising Post-Crisis Reforms .mp4 [ 71.21MB ]

| | | | | 32-FRTB .mp4 [ 68.16MB ]

| | | 1.前导班 [ 458.10MB ]

| | | | 二级前导是复习部分一级的内容.txt [ 0B ]

| | | | P2前导课讲义 [ 34.31MB ]

| | | | | P2前导-P1B1.pdf [ 6.86MB ]

| | | | | P2前导-P1B2.pdf [ 6.26MB ]

| | | | | P2前导-P1B3.pdf [ 11.00MB ]

| | | | | P2前导-P1B4.pdf [ 10.19MB ]

| | | | 定量分析 [ 92.22MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】01 Basic Concepts of Probability [ 23.01MB ]

| | | | | | 1.P2前导-Basic Concepts of Probability.mp4 [ 23.01MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】02 Distributions [ 23.92MB ]

| | | | | | 2.P2前导-Distributions-.mp4 [ 23.92MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】03 Hypothesis testing [ 23.87MB ]

| | | | | | 3.P2前导-Hypothesis testing.mp4 [ 23.87MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】04 Return Volatility and correlation [ 21.43MB ]

| | | | | | 4.P2前导 Return Volatility and correlation-.mp4 [ 21.43MB ]

| | | | 风险管理基础 [ 85.82MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】01 Modern Portfolio Theory [ 26.25MB ]

| | | | | | 1.P2前导Modern Portoflio Theory.mp4 [ 26.25MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】02 Capital Asset Pricing Model [ 30.74MB ]

| | | | | | 2.P2前导Capital Asset Pricing Model.mp4 [ 30.74MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】03 The Arbitrage Pricing Theory [ 28.82MB ]

| | | | | | 3.P2前导The Arbitrage Pricing Theory-.mp4 [ 28.82MB ]

| | | | 估值与风险模型 [ 119.44MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】01 Interest rates [ 35.14MB ]

| | | | | | 1.P2前导Interest rates.mp4 [ 35.14MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】02 Duration [ 15.66MB ]

| | | | | | 2.P2前导Duration.mp4 [ 15.66MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】03 Market risk [ 26.29MB ]

| | | | | | 3.P2前导 Market risk.mp4 [ 26.29MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】04 Credit risk [ 21.77MB ]

| | | | | | 4.P2前导 Credit risk.mp4 [ 21.77MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】05 Operation risk [ 20.59MB ]

| | | | | | 5.P2前导Operation risk.mp4 [ 20.59MB ]

| | | | 金融市场与产品 [ 126.31MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】01 Binomial Trees [ 49.39MB ]

| | | | | | 1.P2前导Binomial Trees.mp4 [ 49.39MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】02 Black_Scholes_Merton Model [ 25.01MB ]

| | | | | | 2.P2前导Black_Scholes_Merton Model.mp4 [ 25.01MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】03 Fund Management [ 30.56MB ]

| | | | | | 3.P2前导Fund Management.mp4 [ 30.56MB ]

| | | | | 【299素材网 网:299sucai.com】【微信号:jzb985】04 Central Counterparties [ 21.35MB ]

| | | | | | 4.P2前导Central Counterparties.mp4 [ 21.35MB ]

| | notes [ 18.65MB ]

| | | FRM 2024 Part II – Schweser NotesBook 1.pdf [ 3.35MB ]

| | | FRM 2024 Part II – Schweser NotesBook 2.pdf [ 4.01MB ]

| | | FRM 2024 Part II – Schweser NotesBook 3.pdf [ 3.11MB ]

| | | FRM 2024 Part II – Schweser NotesBook 4.pdf [ 3.67MB ]

| | | FRM 2024 Part II – Schweser NotesBook 5.pdf [ 3.08MB ]

| | | FRM 2024 Part II – SchweserQuicksheet.pdf [ 1.43MB ]

| | 原版书教材 [ 100.27MB ]

| | | 2024 FRM Exam Part II – 1. Market Risk Measurement and Management.pdf [ 15.37MB ]

| | | 2024 FRM Exam Part II – 2. Credit Risk Measurement and Management.pdf [ 24.26MB ]

| | | 2024 FRM Exam Part II – 3. Operational Risk and Resilience.pdf [ 20.48MB ]

| | | 2024 FRM Exam Part II – 4. Liquidity and Treasury Risk Measurement and Management.pdf [ 24.89MB ]

| | | 2024 FRM Exam Part II – 5. Risk Management and Investment Management.pdf [ 15.27MB ]

———————————————

(本资源为SVIP群分享,◉ 文件路径:【23-24考研考证更新A区】—【其他】,仅供内部学习交流用,不公开售卖!)

🎁 点击成为VIP ☛ 一次性打包获取本站全部资源+赠送各类找资源技巧教学(涵盖考研/考证/外刊/各知识付费平台等)+享永久后续新增